Imagine you were a multimillionaire (like we all wish to be) and see an event you are almost 100% sure is going to happen. For example, if your favorite NBA team was up 10 points with 1 minute left on the clock, there is a very high likelihood of your team winning, so you want to put a large amount of your portfolio on it. You decide to place $200k on the YES side of your team when the YES shares are selling at 98¢ (~204,081 shares). (If your team wins, you profit ~ $4,081) with practically no risk at all. However, if you buy the shares without a limit order, you’re making ~ $3,800. You just lost a free $200 dollars for no reason at all.

How Limit Orders Work

The way a Limit order works is you add your bid price which must be at the top of the order book and when someone’s ask matches your bid price you enter the market. Sounds complicated, but it isn’t too hard if you think about it in a more practical example. Imagine you want to buy a ticket for a sold-out game on a resale website.

- The “Ask” price is what sellers are currently listing tickets for (e.g., $100).

- The “Bid” price is what buyers are willing to pay (e.g., $90).

If you use a limit order, you are setting your own price. You place a “bid” for $90. Your order now sits in the “order book” for all sellers to see. You do not get the ticket instantly. You have to wait until a seller gets desperate and decides to lower their “Ask” price to $90 to match your bid

If you buy without a limit order (a “market order”), you are so desperate for a ticket that you just click “Buy Now” on the cheapest one available, which is the $100 “Ask” price. You get the ticket instantly, but you paid the seller’s higher price than what you wanted losing out on potential profit

In your NBA example, you are placing a limit order (a bid) at 98¢. You’re refusing to pay 99¢. You are simply waiting for a seller to come along and match that 98¢ “Ask” price. This guarantees you only buy at that exact price, locking in your maximum potential profit.

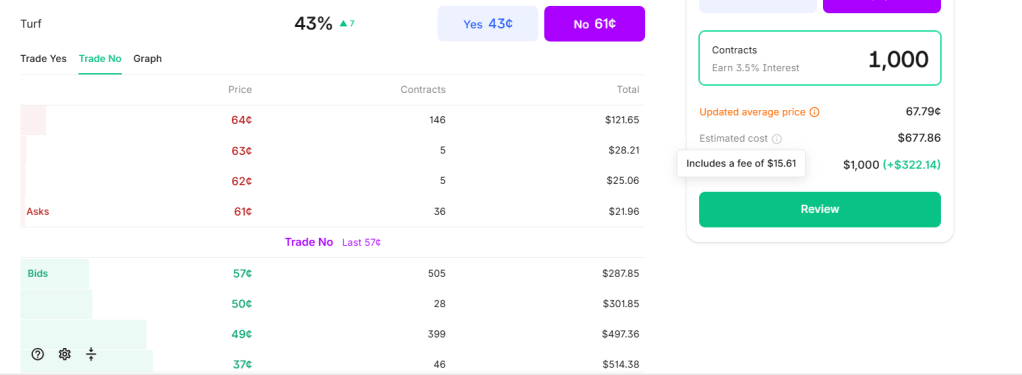

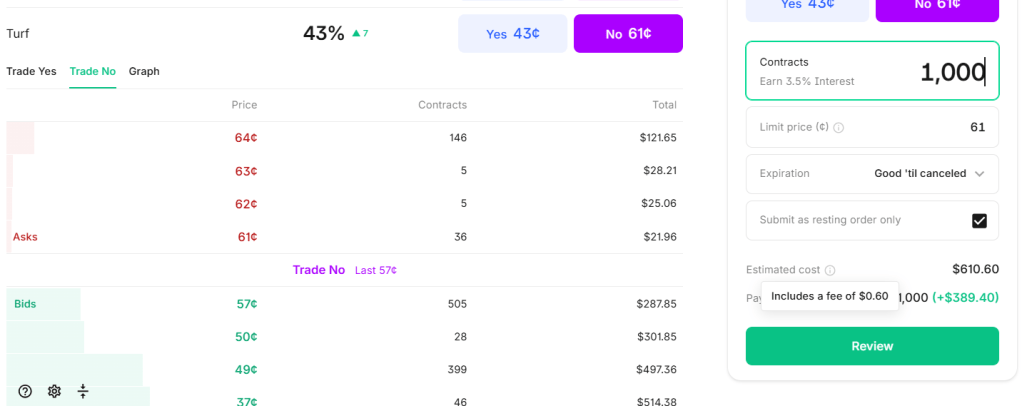

In the example in the images, you are paying 26x the fees and buying contracts at different prices then what you want to buy in.

Now let’s go back to the $200 dollars that you lost because you didn’t place a limit order. On Kalshi, fees are a critical part of this equation. Most modern exchanges, including Kalshi, operate on a “maker-taker” fee model.

- When you use a market order (like you did to lose the $200), you are a “Taker.” You are “taking” liquidity that someone else posted on the order book. For this convenience of an instant trade, you pay a higher transaction fee.

- When you use a limit order (like in your 98¢ example), your order “makes” the market by adding liquidity to the order book. You are a “Maker.” Because you are helping the exchange stay liquid, you are rewarded with a significantly lower fee, and on many markets, you might pay no fee at all.

That $200 you “lost for no reason” wasn’t just from paying a bad price (like 99¢ instead of 98¢). It was a double-hit: you paid a worse price, and you paid a higher “Taker” fee for the “privilege” of an instant, less-efficient trade. The patient multimillionaire who used a limit order not only secured the 98¢ price but also paid a fraction of the fees, protecting their profit from both ends.

How to start using Limit orders

Start small. Trust me start small. Just like anything else you need practice with limit orders. Buy a couple YES/NO shares of some events and see how your order gets filled (ASK matching the bid for you to enter the market). Slowly start increasing then you start making almost all your trades on Kalshi with limit orders exclusively because of the benefits of no/heavily reduced fees and entering the markets at the price you want. Now go make some money!!!

Leave a comment